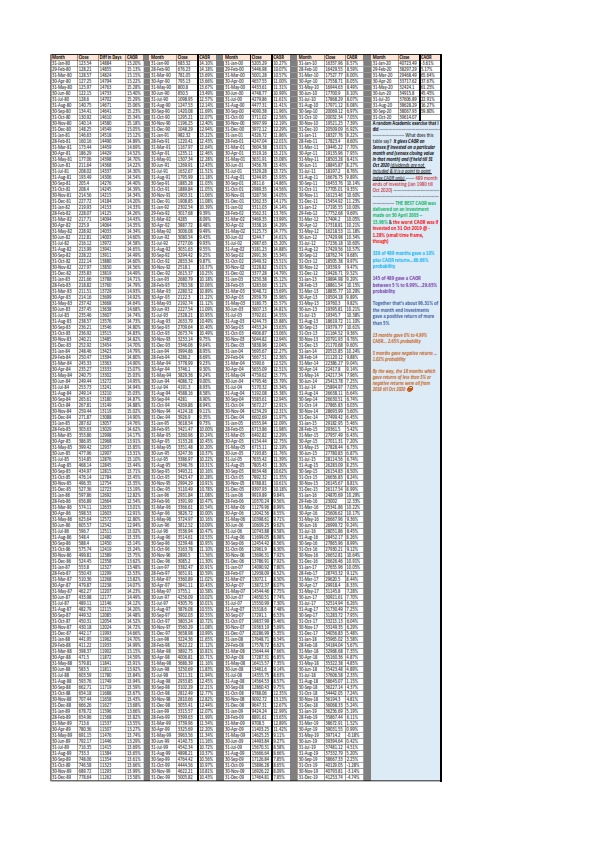

A random Academic exercise that I did

What does this table say? It gives CAGR on Sensex if invested on a particular month end (sensex closing value in that month) and if held till 31 Oct 2020 (dividends are not included & it is a point to point index CAGR only) —— 489 month ends of investing (Jan 1980 till Oct 2020)

The best CAGR was delivered on an investment made on 30 April 2003 @ 15.96% & the worst CAGR was if invested on 31 Oct 2019 @ -1.28% (small time frame, though)

326 of 489 months gave a 10% plus CAGR returns…66.66% probability

145 of 489 months gave a CAGR between 5 % to 9.99%…29.65% probability

Together, that’s about 96.31% of the month end investments gave a positive return of more than 5%

13 months gave 0% to 4.99% CAGR… 2.65% probability

5 months gave negative returns … 1.02% probability

By the way, the 18 months which gave returns of less than 5% or negative returns were all from 2018 till Oct 2020 ?

Who said that long term equity investing need timing?

Yes, if you can

But, all that one needs to do is….Good, bad or ugly days, just keep investing for 20 / 30 / 40 years or more…..money just accumulates in a phenomenal way

By the way…

The worst times to invest in the Sensex and hold until Oct 2020 were the below periods –

All these invested months still gave a higher single digit returnm though

Invested in months of 1992, some months of 1993, many in 1994

Again from Mar 2006 to Sep 2008….all these investments into sensex gave higher single digit returns

And then, the lost decade of 2010 – 2020

Of the 120 months during this period, just 24 months or 20% of the time one had ended up on a double digit return

_*THE LOST DECADE OF INDIAN EQUITIES*_