The MF Flippers are the people who try to keep flipping MFs in their holdings without an idea if this process is adding or destroying their portfolio value ?

I did a small exercise on LARGE CAP mf s for over the last 10/12 years ??????

My Findings:

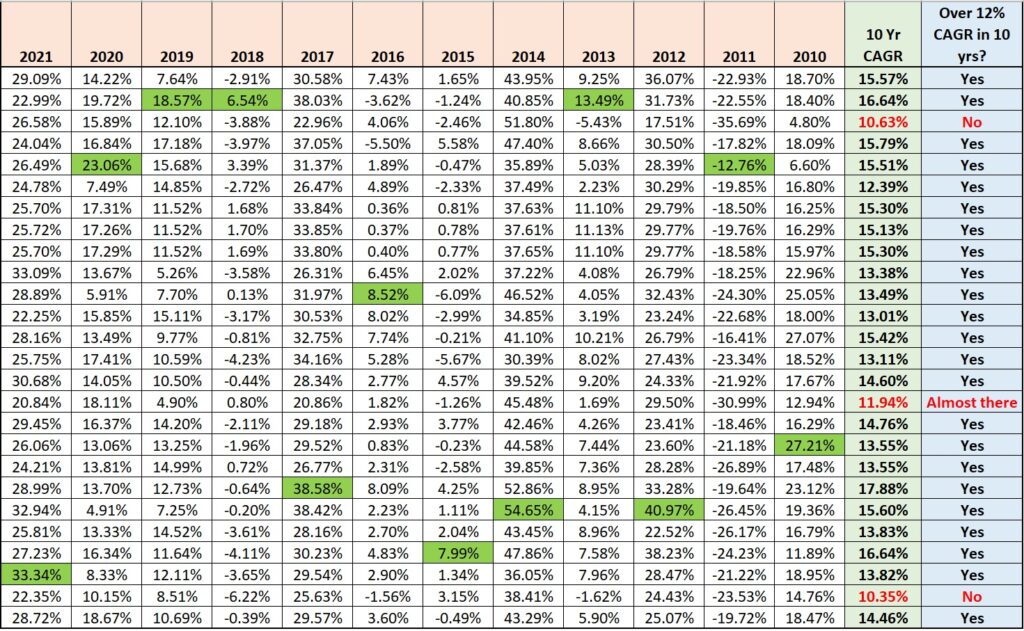

26 schemes which had over 10/12 year history

No specific scheme topped the charts Year on Year. Every year, it was another scheme which was a winner.

One scheme topped in 3 calendar years, and 2 other schemes twice. That’s it (upto mid Sep 2021, from the year 2010)

So, the best of the best probability of a scheme ending on the top of the charts is about 11.5%, in a particular calendar year ??♂️

The scheme which delivered the highest CAGR in about 10 years has topped the category only Once (2017) ???

There are about 6 schemes which never topped the charts in a calendar year but delivered over 15% CAGR (23% of the schemes) ………we don’t see these with a naked eye ?

Just 3 schemes delivered CAGR lower than 12% (one was very close @ 11.94%)….that’s about just 11.5% schemes delivered less than 12%

Meaning……

With an 88.5% probability, one has landed with a comfortable 12% CAGR for over 10 years………without breaking one’s head ??♂️

How has this happened????

Flippers probably don’t win

Sitters win

Well, in reality…. It isn’t so easy to just SIT TIGHT for a long long time ?

Yes most the investors believe in doing something rather than holding for longterm ?