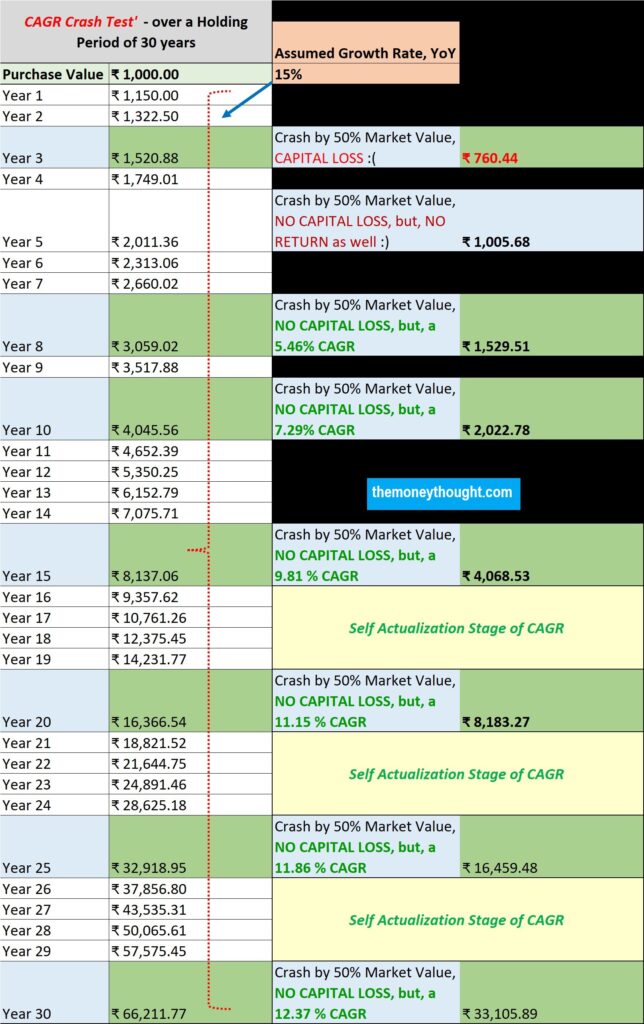

An image from one of my very old posts – sharing again for the benefit of all

How best can we hold our CAGR (compounded annual growth rate), if our investment returns crash by about 50%?

How good is the portfolio muscle strength to withstand the crash impact?

How long does it take to build this strength in the portfolio?

How long does it take for an investment delivering 15% CAGR, to give a safety cushion of returns?

At a 15% high CAGR, it’s takes about 5 years minimum to reach a point of No Gain or Loss state, if the investement value crashes by 50% (5 YEARS JUST FOR no gain or no loss state)

After which, we are In the Money even if the value goes down by 50%

And with a 50% crash at the respective holding periods……the real strength of the investment curtain is raised after 15 years or over of holding period (9.81%) / for 20 years (11.15%) / for 25 years (11.86%) / for 30 years (12.37%)

I call this stage of reasonable or comfortable cushion in CAGR as the “SELF ACTUALIZATION STAGE OF CAGR“

At 15% CAGR it takes 15 years atleast to reach close to a double digit CAGR safety

What happens if the portfolio delivers 12%?

Simple…..it takes a longer time frame to achieve the Self Actualization Stage ?

Have we reached the Self Actualization Stage in our portfolios?

Yes, for some of you who’ve been investing for over a decade ?

How do we know it?

Haven’t we experienced it during the Jan – Mar 2020 crash of 40% (though not 50%) ?

The rest of us should get there.

Just a matter of TIME