Let me bust this myth of High Returns to be achieved for a Better future living standard

Case study –

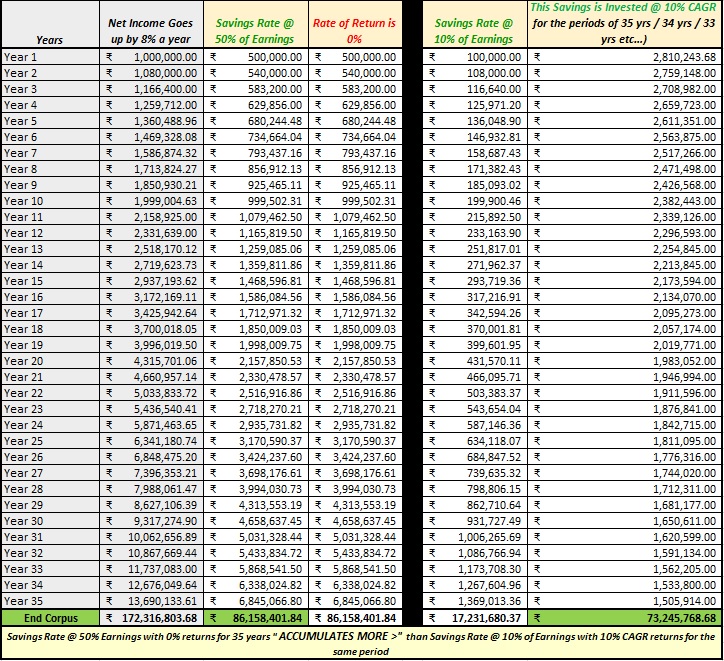

2 Individuals earning ₹ 10 L each net credit as their Income in year 1

Both their incomes consistently grow at 8% YoY, for the next 35 years (Official Inflation rate is taken care)

One saves 50% of earnings and spends 50%, but never invests….all his money is earning 0% return for 35 yrs (assumption for the case)

The other saves a mandatory 10% & invests this savings at a CAGR of 10% per year, for the respective durations until the end of 35th year, but spends the remaining 90%

Both lead a reasonably happy life fulfilling each one’s needs (as they thought)

After 35 years…. Who has a higher accumulated corpus?

Individual 1

Or

Individual 2

?

Here is the answer….

At the end of 35 years – Individual 1 ends up with a higher corpus than Individual 2

0% return beats 10% returns ?

How?

Simple

Higher Savings Rate from Earnings

The problem many face is saving higher from the earnings.

Get that right, returns probably wouldn’t matter

By the way…I could have simple put a returns fig of 3% CAGR as a savings bank rate or even an FD….the equation tilts further into Individual 1 ?

Returns don’t matter if one saves enough

Save more from Earnings

Don’t lose money

These are the 2 critical elements

Adding returns to the higher savings rate is a super bonus 🙂