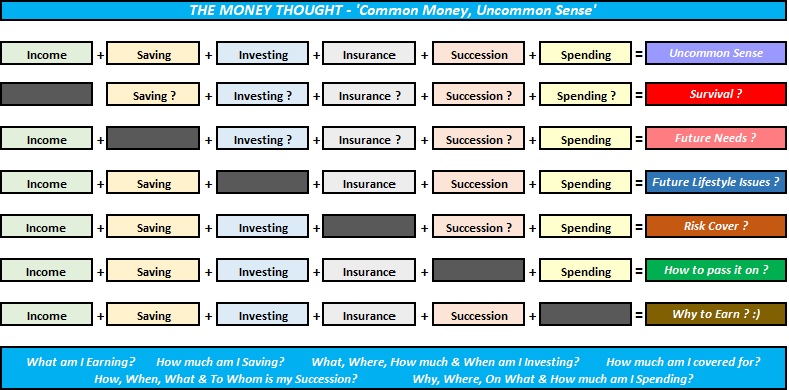

One of my oldest images, that I created but never shared.

This illustration captures all the six core elements of our money life.

- Income

- Saving

- Investing

- Insurance

- Succession

- Spending

I’ll read the illustration out –

If all the six elements are in the right proportions and as is, it’s a blessed money life; but happens only when we work with true ‘uncommon sense’.

If the Income slot is missing – then, there is no scope for the remaining five elements to work with and we are at ‘survival risk’. Should we be there? We should aim for a perpetual Income flow.

If the Savings slot is missing – then, there is no scope for the successive four elements, and we are always in a risk of ‘future needs’ survival? The only way to survive in the present or the future is to always keep earning & spending – Pay Cheque to Pay Cheque living. But, how long can this happen? Not a good state to be in.

If the Investing slot is missing – then, there is a ‘future lifestyle issue’…thanks, to Inflation (our consumed inflation & not the official declared inflation). But, we can hopefully survive on with a really heavy savings rate from our income and or, on reasonable spending cuts (lifestyle). But, our savings % from income earned has to be really high, consistent & for a long time.

If the Insurance slot is missing – then, who is going to cover up for the risk of life, health, goods & services, future earnings for the family etc.? Yes, we don’t need insurance if there is enough in the asset kitty. But, how many have ‘enough’ & how much is ‘enough? to ignore this critical element. We need Insurance as essential.

If the Succession slot is missing – then?, all hell breaks in the family and the rule of the land decides the fate of our assets . Having a clear succession plan is essential. Else, we can live through our life but the purpose of all accumulated wealth might as well get washed and drained in not so a good fashion.

If the Spending slot is missing – then, what’s the purpose of earning? Have a reasonable balanced view – neither over-spending (spend thrift) nor under-spending (miserly) is the way. How to balance this off? The only way is to critically & reasonably evaluate our spends on the basis of our need, comfort or luxury. If this evaluation goes awry, money life is in trouble – no matter how much ever is earned or inherited. It will drain off in no time. And yes, the occasional indulgence in comforts and luxuries is absolutely fine as long as its not shaking the present or future money life.

Finally, I purposely didn’t include ‘borrowing’ as an element is because – we can live without this element ?. It might be important to borrow for some life aspects but definitely not always essential. As much as possible, stay away from this.

Be blessed with the right combination of the six elements and be happy with money & life.