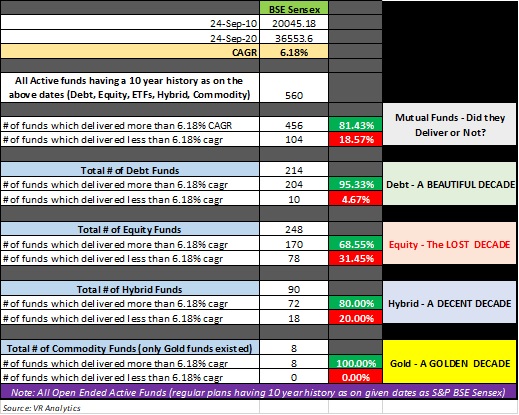

Period – 24 Sep 2010 to 24 Sep 2020

Benchmark – S&P BSE Sensex

MFs – all active funds having a 10 year history between the given dates

Well, it’s been

A beautiful decade for fixed income (the last run from 2018 was dangerous) – 95.33% of fixed income schemes delivered more than the equity benchmark index

A lost decade for equities (not all, though) – about 68.55% equity funds outbeat the main equity benchmark index

A decent decade for hybrids (not the last 3 years) – a decent decade but for the last 3 years of faltering badly (aggressive hybrid schemes)

A golden decade for gold (6 years it stayed in the middle of the pitch going nowhere – 2012 to 18) – continues to have one more decade of golden run, thanks to INR depreciation and world gold price uptick

AMFI promotes a campaign themed “mutual funds sahi hai (mutual funds are the right options)”

Yes, I agree

But, let’s also remember that – “har mutual fund sahi nahi hai (not every mutual fund is a right option for choosing)“

Don’t we know of so many mishaps in this decade itself ?

Now, the bigger questions

Can anyone pls predict to me on the same parameters for the coming decade – 24 Sep 2020 to 24 Sep 2030 ???

Which Asset Class will deliver the best?

Which Index will deliver the best?

Which MF schemes will deliver the best?

Which will shut down?

Which new Regulatory Guidelines will stampede on us?

Which new tax regulations are going to hit?

Which currency will go bust?

and on and on…..

If anyone is sure or even remotely sure, pls revert and I’m ready to learn; because, I have no clue on the next decade

Excellent analysis explained in real sense, i totally agree with you all mutual funds sahi nahi. Did all the direct clients know this i leave it to them

Dear Srinivas,

Thank you