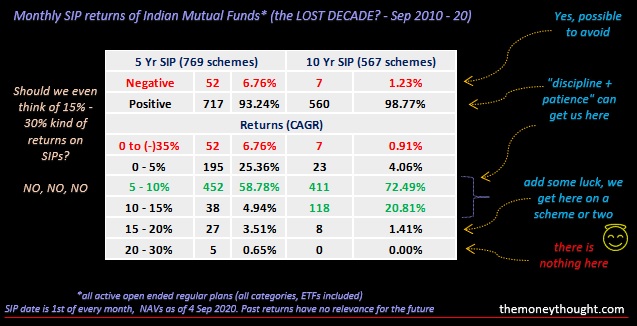

Should we consider this decade (Sep 2010 – 20) as a lost decade for all the SIPpers’ (Systematic Investment Plan) in the Indian Mutual fund industry, from a returns perspective?

I don’t think so. An analysis of the fact checks the same on a 5 year and 10 year tenor monthly SIPs (60 & 120 months). The above table depicts the whole story. Number of schemes compared from the 5 and 10 year period is different because, some of them have not been in existence for 10 years.

Outcomes –

Negative returns on SIP are rare – Yes, they are rare indeed. The longer the tenor of the SIP, the better is the “muscle build in the system to withstand any kind of market downfalls”. About 6.76% of schemes on a 5 year SIP & just about 1.23% of schemes in a 10 year period went negative. And Yes, very likely we can avoid getting here with some basic planning.

Positive returns of 5% – 10% have a historical high probability – about 58.78% of schemes on a 5 year period and 72.49% schemes in a 10 year period fall in this range. And if we just drag the range to 5% – 15%, the % number of schemes delivering positive returns further goes up to 63.72% in 5 years & 93.30% in a 10 year time frame. Meaning, if we can continue our monthly SIPs for over 10 years and beyond, the historical fact shows that the probability of we getting into negative territory of an investment return dramatically falls.

Very high returns from SIPs – Its better to forget about hitting a range of 15% – 30% returns from SIPping. Yes, there are some long standing schemes in the industry which did deliver returns in this range but, history is not future. Let’s keep them aside. With some luck on our side, maybe a scheme or two can deliver in that range, but at a portfolio level, I seriously doubt that happening in the future.

Bottomline, on SIPping –

Ensure to continue for the longest possible time frame (fixed income, equity, hybrid etc.)

The probability of falling into the lowest brackets of returns comes down dramatically as the SIP time frame increases

Discipline in contributions and, Patience during market cycles helps

There are NO SPEED lanes in creating sustainable wealth

Forget those HIGH RETURNs shown from the past

We need LUCK, too ?

Well explained good info.