This is mostly self explanatory, but let me explain what I call the “Monkey Trades” concept – A monkey keeps hopping from branch to branch or from a tree to tree, in search of fun or food. Thats a monkey’s life and it’s living the way it has to. The problem with us is, we get that “monkey behavior” into our equity investing. Jumping from one stock to another, continuously buying and selling.

Majority of investors DO NOT stick to the branch (equity investment) that they have just jumped into. They wish to immediately sell it for a profit and jump onto another branch which probably looks to have sweeter fruits (gains / profits).

The issue is, we will never know if the fruits of the new branch are tastier or worse off than the present one. But, we continue to keep jumping. In the end, most have neither tastier fruits nor fun and are sucked out of their lifeline (money).

A monkey can probably land safely from a height if it misses to catch a branch, but our “moneky trades” will crash land us if we don’t have a branch to hold onto.

Avoid, “Monkey trades”

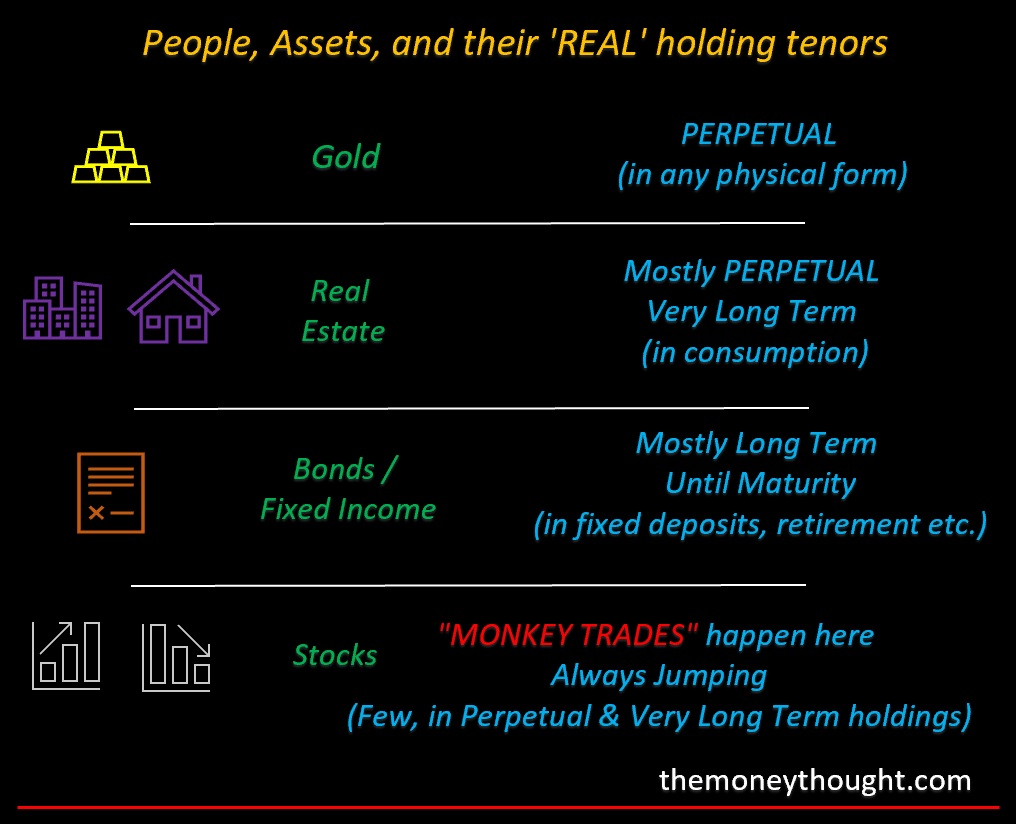

View, “Equities holding tenor” as similar to other assets

A few good humans identify a good branch (equity) and stick onto it for as long as possible tasting the continuous fruits (dividends) that branch keeps delivering. Oh, the branch might just be growing too (capital growth). More fruits in the future from the same branch 🙂

Just to add on the other three assets which we all love to gather…

Gold – the wonderful all pervasive asset in India is Never Ever sold. The Last Standing Asset in a family, and the only saviour in dire situations. So, A PERPETUAL HOLDING. How can we sell, Goddess Lakshmi 🙂 (beware – Gold in Paper Form is not viewed similarly)

Real Estate – the one asset which every living being aspires to acquire in his or her lifetime. Yes, PROPERTY. A home, farm, commercial rental property etc. in any physical and tangible form. We LOVE IT. So, we rarely sell it. How can we sell our dwelling place and the asset which provides us with rental income 🙂

Fixed Income – the so called SAFE & SOUND asset. We save here and try to ensure that there is no loss of capital. Yes, but how many have lost money in this asset? Do we even know? Anyway, we think we are safe here and we wish to be safe here. So, rarely we try to move out, but add into 🙂

Bottomline, each Asset has a place in our life and each Asset has a behaviour of it’s own. Lets not try to mix them and go no where.