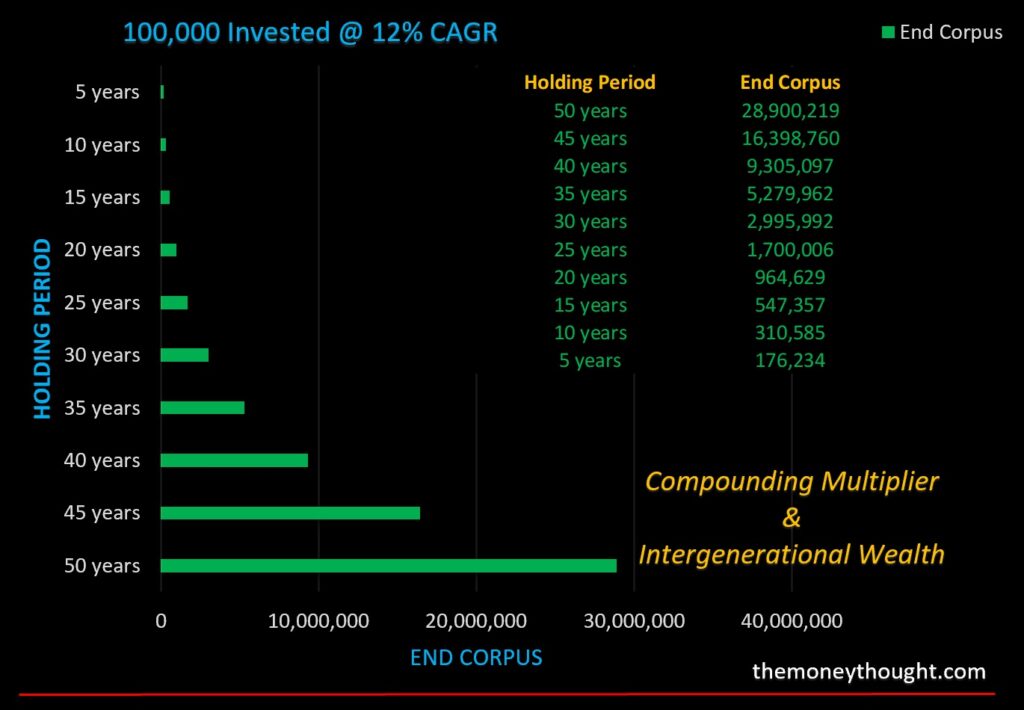

Compounding doesn’t happen over 5,10, 15 or 20 years. It takes decades of investing and patience to make compounding work for us. e.g. 100,000 invested at 12% for 20 years, leads us to a an end corpus of about 964,629. Add 10 years of time frame, we get 2,995,992. And then, add 10 more years of wait, we end up at 9,305,097 – that’s about 3 times of the value we ended up in the first 30 years. Finally, if we can wait for a total period of 50 years….a stellar compounding impact leading to an end corpus of 28,900,219.

The problem in this journey is, we have NO TIME to wait for such a long period in our life. Humans are always in a hurry to get to the next 100,000 or the next million or maybe even the next billion. The shorter the time frame that our money can double, triple or quadruple, the better it is. Because, we just can’t wait.

It is absolutely possible for any reasonably earning individual or a family to create mind boggling and staggering long term wealth for themselves or for their future generation. Little drops of concrete savings and initial corpus is all that is required, along with tonnes of abstract discipline, patience and the right mindset. But, we just can’t do it.

But alas, we miserably fail at it because…

we can’t wait

we don’t have the patience

we don’t have that mindset

we can’t discipline ourselves for such a long time

we don’t visualize 50 years of an investing time frame

Compounding happens at the FARTHEST END of the time frame.

Intergenerational & Sustainable Wealth gets created at the FARTHEST END of the time frame.

Anything which comes in fleetingly, also goes out fleetingly.

The faster the money comes IN, the faster it goes OUT too.

That’s the Money Philosophy.