The human body is quite a complex creature in itself, then, why do we need make every effort to make our lives complex? It’s a real life challenge for each of us to keep life and money issues simple.

But, as humans we love complexity, don’t we?

Simple isn’t great ☹

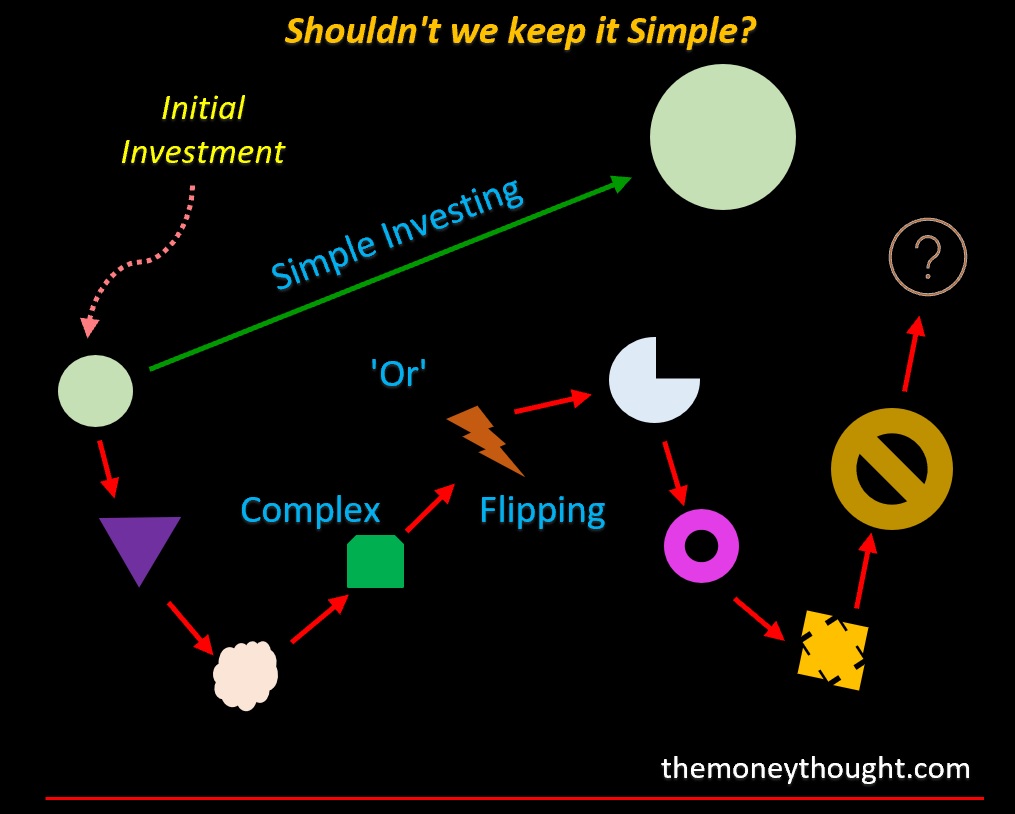

Investing is no different. We love complex investing products and complex investing processes for us to be constantly engaged in. We wish to participate in these complex products and processes, for the fear of missing out (yes, FOMO) on some fantastic ‘next’ investment opportunity eagerly waiting for us.

Simplicity just doesn’t cut the ice.

We love the ‘Activity of Consistently Flipping Investments’ from…

one product to another or

from one stock to another or

from one bond to another or

from one currency to another or

from one asset class to another or

from one commodity to another or

from one mutual fund to another or

from one broker / advisor to another

What is the need?

Where are we headed?

Does this ‘flipping activity really add value to our lives?

If so, can we concretely quantify the abstract pain, pleasure & output from this activity? Maybe, the output in the form of returns, costs and taxes involved can be quantified. But beyond that, everything else looks to be a complex pain to handle.

Yes, there is a need to re-balance and re-visit one’s life and money needs from time to time. But, that doesn’t mean we keep making things complex.

Invest Simple

Keep Money and Life Simple