This company’s Dividend yield is about 2.7% (now)….way higher than many

It was almost flat for a long time

But last year or two….it went up only in one direction

We just had some academic discussions on this stock with some of you during covid and later as well

Available for as low at ₹ 136 at low covid, now at ₹ 468 + all the tonnes of dividends 😊

Guess it?

Many times….We miss good companies for good prices

Many times…..We buy good companies at bad prices

We’re pretty good at buying bad companies for bad prices

ITC…..the company that runs on value

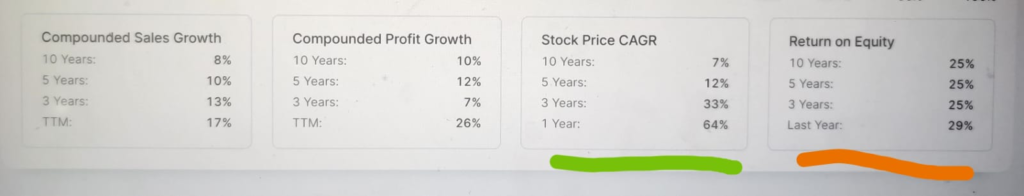

Was a value trap, if bought 10 yrs ago (10 year CAGR is about 7% as of today)

Was a value gap (stock), if bought 3 or 4 yrs ago

Understanding the difference between the TRAP & GAP, is a skill that not many have in this world

As always, many investors over estimate their SKILL and underestimate their LUCK 😊