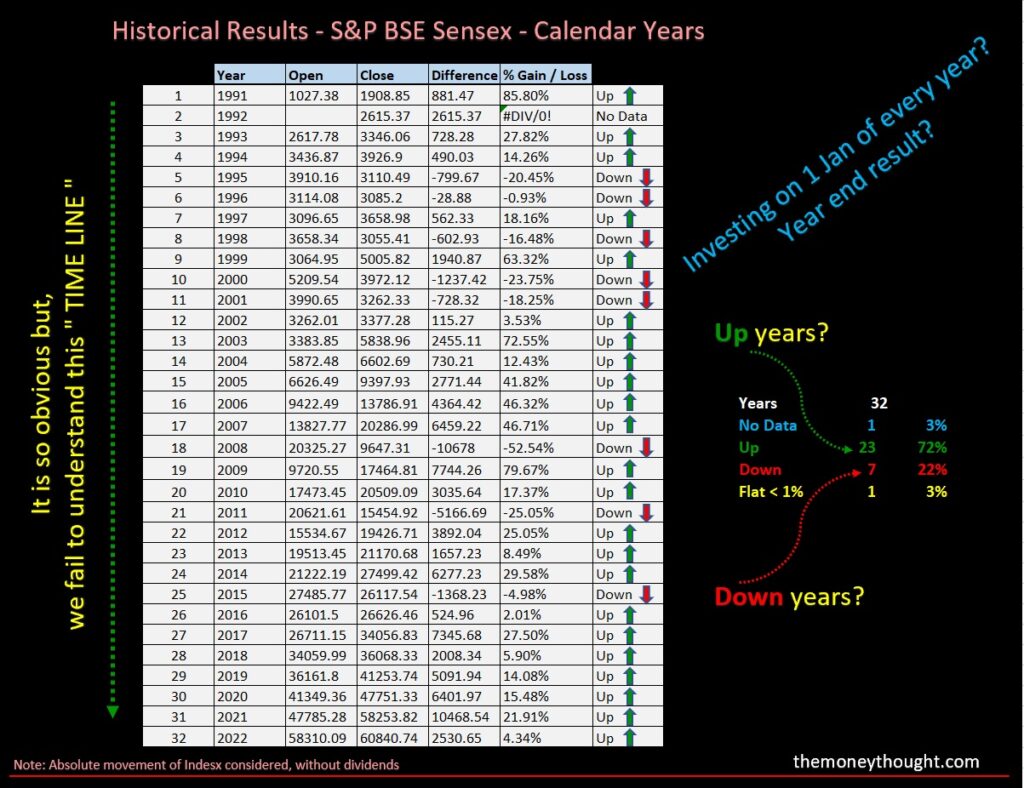

Beginning of every calendar year, i just try to share the above table.

Many things in life & money are quite obvious. We know them too well, but still fail to execute in life. Why?

Is it our biases?

Is it our lack of patience?

Is it our skewed thought process?

Is it our perceived belief system?

I don’t know, but surely history teaches us, if and only we try to learn from it ??♂️

Investing just on the 1 st day of Jan every year itself is probably enough ?…..look at the table on the index performance for over 32 years –

We’re UP by the end of the year 72% of the years

We’re DOWN by about 22% of the years

We’re flat & with No data for about 3% each of the years

Now….. Let me dissect it further –

Over the last 21 years, since 2002 – there have been only 3 calendar years that the S&P BSE Sensex hasn’t delivered a positive return by the end of that particular calendar year?

That’s a whopping 85.71% of the times, it ended positive, with just 14.29% of the time ending down from the start of that year of the 3 times it ended negative – 2008, 2011 we’re high to very high double digit downtrends and 2015 with just about 4.98% lower from the start of the year.

Now…… I’ll urge you to check on the # of times the index would have ended lower in the subsequent year ends, compared to the start of a particular year when we invested. E.g. 2002 start was 3262 and we never closed for a lower index # than this at any other subsequent year closes. But there are very few years where this trend differed, but by a close margin only.

We either learn from history or we just don’t

My theory of investing on the first day of every year and just holding on is just fine with a very high probability rate of success – the only other times to keep investing are – daily, monthly, when the markets fall, when the markets are volatile & when the markets keep going up too ?

Happy New Year Investing ??