It is said that…It’s all in our mind ??♂️

That might be true for life, but while investing, it’s a NO

It’s all in our holding period

Why do I say this?

I did one more random academic exercise on the 40 yrs of BSE Sensex movement / returns

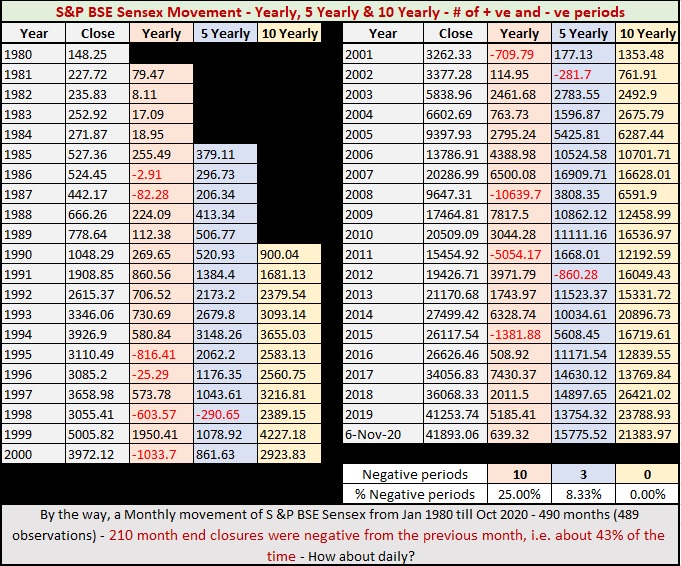

Period covered – Jan 1980 to 6 Nov 2020

How many months did the index move down from the pervious month’s close?

How many years (calendar year) did the index move down from the beginning of the year?

How many times was the index lower in a 5 year roll over time frame?

How many times was the index lower in a 10 year roll over time frame?

Well…the results are in the #s

Of the 489 monthly observations, the index closed 210 times on the lower side Vs the previous month – that’s about 43% of the time….. meaning, 57% probability of index ending higher from the previous month but, it’s a very random movement

Investing on the 1st of Jan every year and checking the value on 31 Dec of that year – there are just 10 years or 25% (of the 40 yrs) that one ended on the lower side….meaning, if we follow this strategy, there’s a 75% probability on we ending higher every year end ? (invest in Jan ?)

Investing on the 1st of Jan and waiting for 5 yrs (36 observations of 5 yr roll over periods) – just 3 times that we end negative….meaning, about 92% probability that our investment into the index ends on a positive return

Finally, Investing on the 1st of Jan and waiting for 10 yrs (31 observations of 10 yr roll over periods) – 0 times that we end negative….meaning, 100% probability that our investment into the index ends on a positive return

Bottomline….

The pain of losing capital is not the equity index’s fault.

IT IS THE INVESTORS FAULT

Just Stay Invested

Ups and Downs just don’t matter … Atleast, the history says so ??♂️