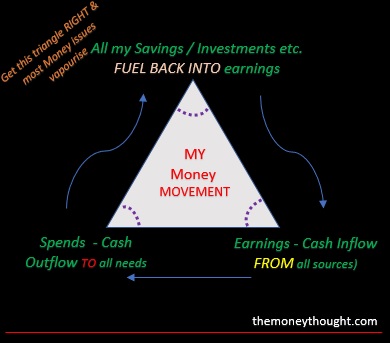

A simple concept but yet complicated in execution for many – ‘money movement’, that all struggle to understand, manage or execute

My Earnings give me the required ‘cash inflows’

for

My Spends called ‘cash outflows’, towards my consumptions and taxes

Now, this is a basic one way mechanism – Earnings to Spends

On the top of this triangle is an element which is critical but yet many fail to understand or structurally build this angle into their money & life – ‘My Savings & Investments’

Why do we need to build this cap?

Because it safeguards us and provides us for ‘future uncertainties’

But even more than that, it acts as a catalyst or a rocket fuel for enhancing future earnings

How?

By creating consistent Cash Inflows from the investments, which can get channelized back into our base ‘earnings’

This is the cycle of ‘my money movement’ or ‘my money competence’ or ‘my money compounding’

Get this cycle right, most money life issues get controlled

Earnings is the primary source

Spending is an option

Savings & Investing are mandatory

Note: Spending before Saving or Saving before spending – this order doesn’t matter if the spending side is controlled 🙂