Albert Einstein once said, Compound Interest is the eighth wonder of the world. Well, that is what is attributed to him.

Did he indeed ever say this statement?

I don’t think for the reason; his IQ was far higher & would have probably made a statement like, “Compound Interest is the only wonder, on Investments”

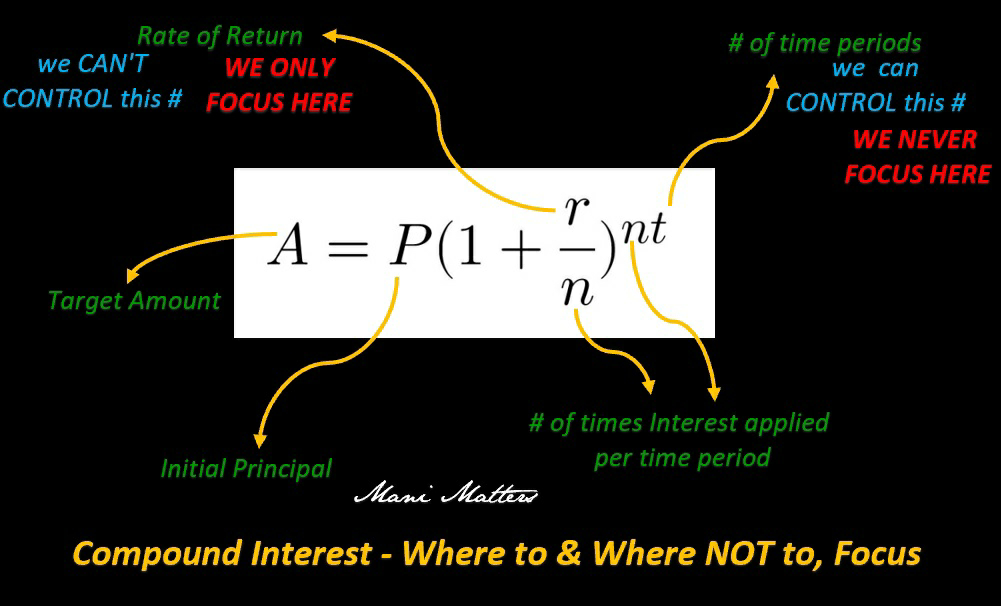

I’ve enclosed the compound interest formula which details each variable.

While, all the 3 variables make a reasonable impact on the end result A (target amount); the most important variable which is under our control to a large extent but also, the least ignored is t (time)

We tend to focus primarily on r (rate of return), which is by all means way beyond our control; always and ever. Yes, the rate of return can be known in advance (when investing into fixed income deposit) but, can it be controlled? NO

So, why do we never speak of 15 / 20 / 25 / 30 / 40 / 50 years of investing time frames?

GREED; to make more money at the shorter end of the time frame & FEAR; yes, fear of unknown at the longer holding periods.

The unfortunate truth is – ‘we are quite good at compounding GREED at the shorter end & compounding FEAR at the longer end of time frames, but never ever understand the impactful COMPOUNDING RATE OF RETURN at the long end

“GREED for shorter time frame & FEAR for longer time frames – dispense off with them, if COMPOUND INTEREST has to work in your favour“

FOCUS, where we need to FOCUS – the “t”

Note: Well, P the principal amount is also under our control, except when people get to play smart by leveraging. In which scenario, P is actually not “Our P”; it becomes a dangerous B (borrowing)